Bitcoin Price Prediction as BlackRock’s 71-Day ETF Inflows Streak Ends – Is a Bear Market Starting?

As BlackRock’s 71-day ETF inflow streak comes to an end, the Bitcoin market faces new uncertainties. Despite a modest increase to $64,165, Bitcoin’s trading dynamics hint at potential volatility. This update provides a Bitcoin price prediction in light of recent financial shifts.

BlackRock’s IBIT, a spot bitcoin ETF trading on Nasdaq, experienced a noticeable decline in popularity, according to preliminary data from Farside Investors.

For the first time since its launch on January 11, IBIT failed to attract any new investments, ending its 71-day streak of continuous inflows. This trend was echoed by seven out of ten similar funds.

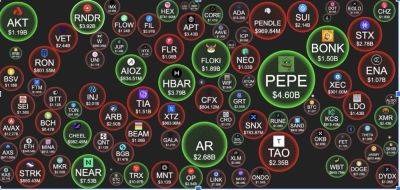

Meanwhile, Fidelity’s FBTC and the ARK 21Shares Bitcoin ETF saw modest inflows of $5.6 million and $4.2 million, respectively.

In contrast, Grayscale’s GBTC faced significant withdrawals, with $130.4 million exiting the fund, culminating in a net outflow of $120.6 million—the largest since April 17.

Despite a strong start with heavy initial investment, the overall enthusiasm for these bitcoin ETFs has cooled off this month, dampening the previous momentum in the bitcoin market.

Hong Kong is gearing up to launch Bitcoin and Ether ETFs by the end of April, aiming to position itself as a major digital asset hub. This move is set to challenge the dominance of the United States, where similar funds have accumulated $56 billion.

However, Hong Kong faces challenges, including lower brand recognition compared to U.S. giants like BlackRock and Fidelity, and it must also navigate local demand and regulatory hurdles.

Hong Kong is set to follow in the footsteps of the US by listing a batch of cryptocurrency ETFs, providing a window on whether the city is making progress on fashioning a hub for digital assets

Read more on cryptonews.com