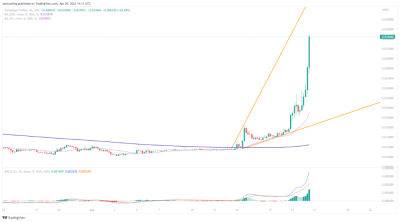

Bitcoin Price and Ethereum Prediction: BTC & ETH Catch Their Breath After 5% Leap – Buckle Up, What's Around the Corner?

In the world of cryptocurrencies, Bitcoin and Ethereum have recently experienced a noteworthy 5% surge in their prices, momentarily pausing as they prepare for their next move. As investors and market enthusiasts closely monitor the situation, anticipation builds around the future for these leading digital assets. Will they continue their upward trajectory or face a potential correction?

Let's explore the factors influencing BTC and ETH prices and what may be just around the corner.

BTC/USD is trading at 30,268, up 2.50% in 24 hours. As investors raised their bets that the US Federal Reserve would soon cease its hawkish policy, the most valuable cryptocurrency reached $30,000 for the first time in ten months.

In the US, the official jobs report from the previous week, released on Good Friday, revealed a robust job market that helped lower the unemployment rate to 3.5%. This strongly suggests that further interest rate increases are possible when Federal Reserve officials meet again in May. However, this report contrasts with earlier weak data, which showed that US job postings dropped to their lowest level in over two years in February.

This focuses on Wednesday's inflation figures and the Fed's March meeting minutes.

Recent banking industry turbulence and the slowdown of the US economy have fueled hopes that the central bank would soon halt its aggressive monetary tightening campaign.

As a result, markets are awaiting the CPI data to determine the Fed's next moves. If the data indicates decreasing inflation, this could be the next potential driver for an increase in the BTC/USD price.

Meanwhile, the market's prediction that the Fed would raise rates by 25 basis points at its May meeting has dropped to 66.5%, while the

Read more on cryptonews.com