Bitcoin metric that 'looks into future' eyes $48K BTC price around ETF

Bitcoin (BTC) may cruise to nearly $50,000 as the United States okays the first spot price exchange-traded fund (ETF).

As flagged by popular analyst CryptoCon, the Ichimoku Cloud indicator is counting down to upside BTC price continuation.

Bitcoin is in a rare position on weekly timeframes when it comes to Ichimoku Cloud signals.

As Cointelegraph reported, the indicator, which combines past, present and future trading cues, suggests that the BTC price gains have only just begun.

In a post on X (formerly Twitter) on Nov. 27, CryptoCon was able to deliver a specific target for what could happen next.

Ichimoku’s leading spans have crossed, leading to the formation of a new upside cloud. With the lagging span, Chikou, breaking out of resistance, price should now logically head higher.

“The Weekly Ichimoku cloud called our last Bitcoin rise to 38k 2 months in advance with the cross projected in the future,” he wrote.

CryptoCon added that $43,200 was in fact the “most conservative level,” and that $48,000 was a suitable ceiling.

He concluded:

Bitcoin traded at $37,000 at the time of writing on Nov. 28, per data from Cointelegraph Markets Pro and TradingView.

Ichimoku’s timing is arguably as interesting as its targets.

Related: $48K is now ‘reasonable’ BTC price target — DecenTrader’s Filbfilb

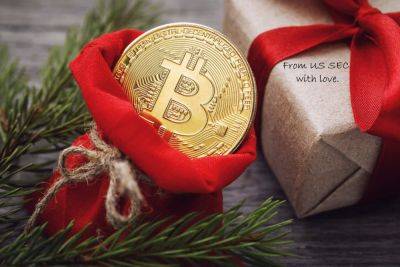

Should traditional timing play out, based on previous bull markets, the $48,000 move should come in early January — coinciding with the expected ETF approval date.

Little is known about what U.S. regulators have in store, or which specific ETF products, if any, will get the green light first.

In the meantime, the Securities and Exchange Commission (SEC), in charge of the ETFs coming to market, continues to pressure crypto sentiment with

Read more on cointelegraph.com