Bitcoin-friendly PPI data boosts bulls as Ether price fights for $2K

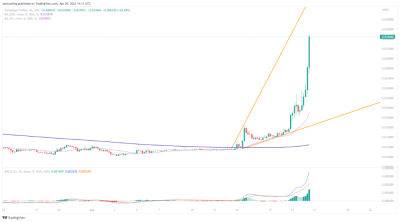

Bitcoin (BTC) preserved $30,000 support at the April 12 Wall Street open as more United States macroeconomic data boosted bulls.

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD hovering near $30,250 on Bitstamp.

Amid a slowdown in volatility, U.S. Producer Price Inflation (PPI) data provided a timely hint that inflation was slowing faster than expected.

Headline PPI came in at 2.7% year-on-year versus market expectations of 3% — an encouraging result for risk assets.

US March PPI fell 0.5% MoM, below estimate of 0%, in another sign that US #inflation may have peaked. pic.twitter.com/mfI7ab03ev

Financial commentary resource The Kobeissi Letter was among those noting that the month-on-month drop in PPI values was the largest since the peak in March 2022.

“The overall PPI inflation rate has fallen from 11.3% to 2.7% since June 2022, less than 1 year ago. There also has not been a monthly increase in PPI inflation since June 2022,” it added.

Reacting, market commentator Tedtalksmacro suggested that the numbers would also provide a snowball effect for another key inflation metric, the Consumer Price Index (CPI), the March print for which also beat prognoses.

“Indicative of further falls in CPI/PCE in coming months,” he summarized in comments about the PPI result.

Inflation subsiding faster has traditionally buoyed cryptoasset performance as it raises hopes that U.S. economic policy will become less restrictive.

A key event for market participants now will be the Federal Reserve’s next interest rate change, the decision on which is due in May.

According to CME Group’s FedWatch Tool, expectations still favored a further rate hike of 0.25%, with PPI notably doing little to change the mood.

While holding $30,000 as

Read more on cointelegraph.com