Bitcoin, Ether extend crypto selloff as big Fed rate hike looms

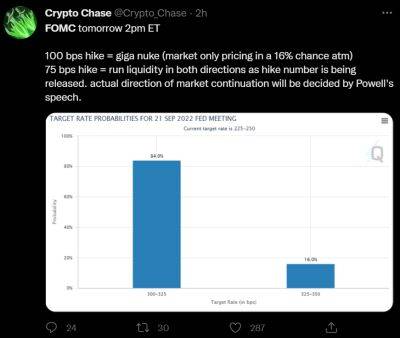

Cryptocurrencies extended a slide on Monday, hampered by a further drop in the second-largest token Ether as well as the prospect of a global wave of monetary tightening this week spanning the US to Europe.

Ether fell as much as 5.6 percent to a two-month low and was trading around $1,302 as of 10:35 am in Singapore, while Bitcoin shed about 5 percent to recede below $19,000. Tokens like XRP, Avalanche and Polkadot posted heavier losses.

An Ether jump since mid-June that was spurred by hype around an upgrade of the Ethereum blockchain is rapidly unwinding now the revamp is done. Meanwhile, investors are bracing for volatility from the jumbo interest-rate hike expected this week from the Federal Reserve to fight price pressures.

The Ethereum update - the Merge - to slash energy usage is a “ginormous shift” but “in this inflationary environment macro trumps everything,” Antoni Trenchev, managing partner at crypto lender Nexo, wrote in a note.

That’s evident in the pressure on a range of assets: global stocks are closer to wiping out a climb since mid-June that for many was a bear-market rally. US equity futures were in the red Monday, while a dollar gauge pushed higher.

Read more on moneycontrol.com