Bitcoin Crash Shaves A Third Of El Salvador's Government Holdings: Report

Crypto crash leaves El Salvador with no easy exit from worsening crisis

El Salvador's big bet on bitcoin, which the Central American nation has been buying since September, has soured in recent weeks as a cryptocurrency rout shaved over a third of the value of the government's holdings, Reuters calculations show.

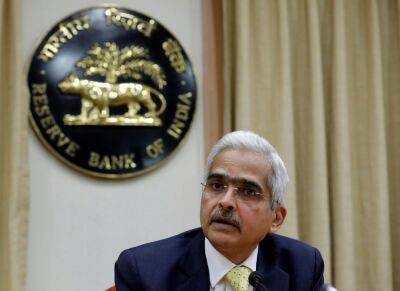

Under populist President Nayib Bukele, a vocal cheerleader for the currency, El Salvador went all-in on bitcoin, not just becoming the world's first country to adopt it as a legal tender but also sketching out plans for a volcano-powered crypto mining hub and plans to issue the first sovereign bond linked to the coin.

With global borrowing costs on the rise and a big debt repayment on the horizon, El Salvador has other fiscal headaches than the impact of the currency's swoon. But the crypto slump has also closed some potential off-ramps from the crisis, including the now-postponed bitcoin bond.

"The government's financial problems are not because of bitcoin, but they have gotten worse because of bitcoin," said Ricardo Castaneda, senior economist and country coordinator for El Salvador and Honduras at think tank Central American Institute for Fiscal Studies (ICEFI). For the government, he said, "bitcoin ceased to be a solution and has become part of the problem."

Bitcoin has fallen 45% since El Salvador officially adopted it in early September, and 26% from its May high as crypto assets have been swept up in a risk-off investing environment.

The combined market value of all cryptocurrencies recently fell to $1.2 trillion, less than half of where it was last November, based on data from CoinMarketCap.

El Salvador's debt stood at $24.4 billion as of December, from $19.8 billion at end-2019, after the Bukele administration

Read more on ndtv.com