Bitcoin [BTC] to slide under $20k soon? These metrics suggest…

Bitcoin [BTC] managed to stay above $25,000 for a few days, which gave investors a reason to celebrate. As per CoinMarketCap, BTC was up by over 5% in the last 24 hours.

At the time of writing, it was trading at $25,999.75 with a market capitalization of over $502 billion. However, the celebration might be nearing an end as BTC might be subjected to yet another price correction.

Read Bitcoin’s [BTC] Price Prediction 2023-24

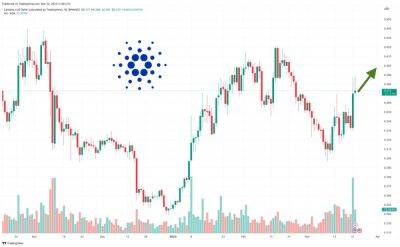

Onchain Edge, an author, and analyst at CryptoQuant, recently published an analysis that suggested the possibility of a price correction.

As per the post, BTC’s Network Value to Transaction (NVT) golden cross reached 8.49. This indicated a possible market top, which can result in increased selling pressure.

Therefore, BTC ’s price might plummet in the near term. To clear the air, the NVT Ratio describes the relationship between market cap and transfer volume. The NVT Golden Cross indicator helps traders decide whether to buy or sell a cryptocurrency.

Source: CryptoQuant

Selling pressure might already have increased as CryptoQuant’s data revealed that BTC’s exchange reserve was rising. Not only that, but BTC’s aSORP was red, suggesting that more investors were selling at a profit.

Thus, increasing the chances of a trend reversal. As per Santiment’s chart, BTC ’s supply on exchanges increased while its supply outside of exchanges went down, which was by and large a bearish signal.

Positive sentiments around BTC also seemed to have declined over the last few days, which was evident from the weighted sentiment metric.

Source: Santiment

Is your portfolio green? Check the Bitcoin Profit Calculator

Despite all the negative signals, things might continue to remain in BTC’s favor in the near

Read more on ambcrypto.com

![Bitcoin [BTC] bulls undeterred by macro mayhem, new report shows - ambcrypto.com](https://finance-news.co/storage/thumbs_400/img/2023/3/23/61148_uwnb.jpg)

![Bitcoin [BTC] miners see green: Will there be a relief in selling pressure - ambcrypto.com](https://finance-news.co/storage/thumbs_400/img/2023/3/22/61135_xxuf1.jpg)