Bitcoin: Assessing the good, bad, and ugly as BTC ‘Marches’ into April

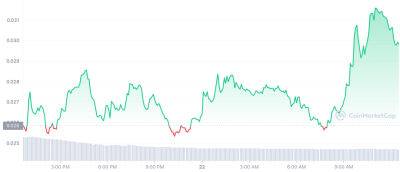

The crypto market, led by the quarter-reviving Bitcoin [BTC], had a march full of ups and downs in between cynical and optimistic views. Nevertheless, the king coin could end the month with a 21.49% 30-day hike. However, there has been some development around the market propelled by macroeconomic factors and cycle reversal.

How much are 1,10,100 BTCs worth today ?

As such, the latest Capriole newsletter , put together by Charles Edwards, touched on this aspect.

According to the digital asset hedge fund, BTC’s price action has been largely fueled by organic demand. This was because the perpetual dominance has been in a free fall for quite some time.

The metric describes the established ratio of derivatives trading to spot positions. And with the perpetual dominance down, it meant that spot drove appreciation, and the early bull market stages might be here.

Source: Capriole

However, it is important to admit that the ecosystem struggled with regulatory issues and traditional financial problems.

But it seemed Bitcoin has been able to withstand the heat. As a matter of fact, these challenges helped raise the Short-to-Long-Term Realized Value (SLRV) ribbons . This implied that short-term market activity outpaced the long-term. In Capriole’s words,

“In Q4 2022, the ribbons bottomed at levels comparable to the 2018 lows, and have since gone exponential into Q1 2023. This is another clear sign of a macro shift in Bitcoin adoption.”

Source: Glassnode

Furthermore, the report noted that the current liquidity crisis was just one out of two. And the Bitcoin reaction to the first could be similar to the latter part, especially with regulators and institutions out of the U.S. easing their persecution of the digital asset industry.

A

Read more on ambcrypto.com