BIS data shows unstoppable CBDC momentum

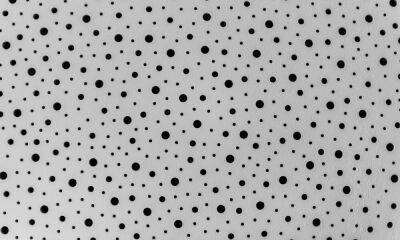

Both Covid-19 and the emergence of stablecoins and other cryptocurrencies have accelerated the work on CBDCs - especially in advanced economies, where central banks say that financial stability has increased in importance as a motivation for their CBDC involvement.Globally, more than two thirds of central banks consider that they are likely to or might possibly issue a retail CBDC in either the short or medium term. Compared with last year, the share of central banks currently developing a CBDC or running a pilot almost doubled from 14% to 26%.

Also, 62% are conducting experiments or proofs-of-concept.Behind the scenes, work is also progressing on the preparing the legal foundations for CBDC issuance.Compared with last year, the share of central banks with a legal authority to issue a CBDC increased from 18% to 26%. In addition, about 10% of jurisdictions are currently changing their laws.

Read more on finextra.com