Biggest Crypto Gainers Today on DEXTools – Rock, Flash, SS

Blue chip cryptocurrencies like Bitcoin (BTC) and Ether (ETH) are ebbing lower on the first day of August, with both hitting fresh one-and-a-half month lows under $29,000 and in the low $1,800s, respectively.

Market commentators are citing jitters over the hack of one of Decentralized Finance (DeFi)’s oldest and most trusted decentralized exchanges (DEX) Curve Finance over the weekend as weighing on sentiment somewhat, as trust in DeFi as a whole takes a hit.

Others have pointed to a new US Securities and Exchange Commission lawsuits against the founder of Hex, PulseChain and PulseX Richard Heart for issuing unlicensed securities and for misappropriating investor funds.

Both could be having an impact but, in truth, the crypto market has well and truly entered its summer lull, with volumes dampened by a much larger than-usual proportion of market participants away on vacation.

Today’s main US economic data – the JOLTS Jobs Opening report and ISM Manufacturing PMI survey – was broadly as expected.

Existing narratives surrounding the US economy, such as that the labor market remains robust, that deflation continues and that the manufacturing sector remains contractionary (but the broader economy is holding up well), remain unchallenged, thus providing little impulse to crypto markets.

Fresh good news regarding other major crypto market themes, like the status of spot bitcoin ETF applications, and regulations, also remains non-existent, giving the market little reason to move higher.

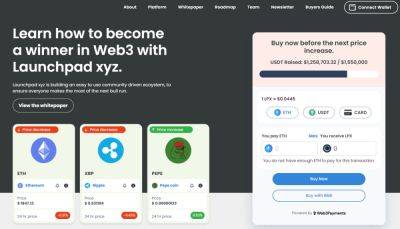

With price action in blue chip crypto markets subdued, degens unsurprisingly continue to hunt for volatility and the prospect of short-term gains in the meme coin/shitcoin market.

Here are some of the top-gaining Ethereum-based coins of the day, as

Read more on cryptonews.com