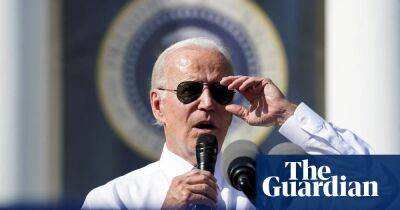

Biden's Budget Proposal Includes Crackdown on Crypto Wash Sales and Doubling of Capital Gains Tax for Certain Investors

President Joe Biden's upcoming budget proposal includes a few surprises for crypto traders and investors, as it seeks to raise around $24 billion through changes to crypto tax treatment. The proposal includes a crackdown on crypto wash sales, which are not currently subject to the same rules as stocks and bonds under current wash sale rules, and a doubling of the capital gains tax for certain investors.

One of the proposals aims to eliminate the tax-loss harvesting strategy used by crypto traders. This strategy allows traders to sell assets at a loss for tax purposes before immediately repurchasing them. The proposal seeks to put an end to this strategy, which is not permitted when stocks and bonds are involved, by applying the same wash sale rules to digital assets. If implemented, this change could have significant implications for many crypto holders who entered the market during the 2021 market peaks and are currently suffering from heavy losses.

The Biden budget proposal also seeks to raise the capital gains tax rate for investors making at least $1 million to 39.6%, nearly double the current rate of 20%. This change would only apply to a certain subset of investors, according to a Bloomberg report.

These proposed changes to crypto tax treatment are part of Biden's plan to reduce the deficit by nearly $3 trillion over the next decade. The budget proposal also includes plans to raise income levies on corporations and wealthy Americans.

The crackdown on crypto wash sales and the proposed doubling of the capital gains tax rate have sparked concerns among crypto traders and investors. However, some experts believe that these changes are an inevitable consideration for the U.S., as it would put it on par with

Read more on blockchain.news

![Stellar Lumens [XLM] surges past two-month resistance, breaches $0.1 - ambcrypto.com](https://finance-news.co/storage/thumbs_400/img/2023/3/29/62101_yzm.jpg)