Bankers’ pitch to save First Republic: Help us now, or pay more later when it fails

In this article

The best hope for avoiding a collapse of ailing lender First Republic hinges on how persuasive one group of bankers can be with another group of bankers.

Advisors to First Republic will attempt to cajole the big U.S. banks who've already propped it up into doing one more favor, CNBC has learned.

The pitch will go something like this, according to bankers with knowledge of the situation: Purchase bonds from First Republic at above-market rates for a total loss of a few billion dollars – or face roughly $30 billion in FDIC fees when First Republic fails.

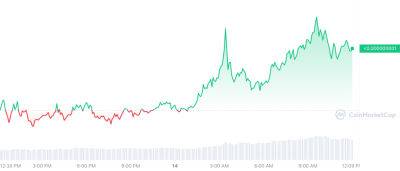

It's the latest twist in a weekslong saga sparked by the sudden collapse of Silicon Valley Bank last month. Days after the government seized SVB and Signature, mid-sized banks hit by severe deposit runs, the country's biggest banks banded together to inject $30 billion in deposits into First Republic. That solution proved fleeting after the depth of the company's problems became known.

If the First Republic advisors manage to convince big banks to purchase bonds for more than they are worth — to take the hit of investment losses for the good of the banking system, as well as their own welfare — then they are confident that other parties will step up to help the bank recapitalize itself.

The advisors have already lined up potential purchasers of new First Republic stock in that scenario, according to the sources.

These investment bankers are now seeking to create a sense of urgency. CNBC's David Faber, who first reported on the latest rescue plan Tuesday, said that the coming days are crucial for First Republic.

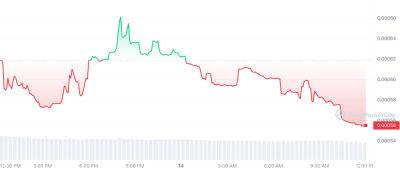

The bank's stock has been in freefall since disclosing Monday that its deposits fell a staggering 40.8% recently, leaving it with $104.5 billion in

Read more on cnbc.com