Are U.S. seniors among the developed world's poorest? It depends on your point of view

The U.S. retirement system is a sprawling complex, a so-called "three-legged stool" of Social Security payments, workplace savings plans and individual wealth.

But is the system falling short in its primary goal of achieving a secure retirement for all Americans?

Judging why and to what extent seniors may be falling behind is harder than it might sound, experts said.

More from Personal Finance: You may be overlooking an important point about target-date funds 37% of baby boomers have more stock exposure than they should Social Security won't run out, but your check might not be what you're expecting

But the answer has huge policy implications, ranging from the generosity of public benefits to the prevalence of employer-sponsored plans such as 401(k)s and pensions.

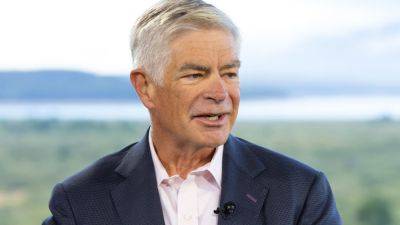

«This is a fraught area,» said Olivia Mitchell, a professor of business economics and public policy at the University of Pennsylvania and executive director of the Pension Research Council. «There's not a simple answer.»

Consider this thought exercise: What is a tolerable poverty rate among American seniors?

By one metric, the U.S. fares worse than most other developed nations in this category.

About 23% of Americans over age 65 live in poverty, according to the Organization for Economic Co-operation and Development. This ranks the U.S. behind 30 other countries in the 38-member bloc, which collectively has an average poverty rate of 13.1%.

According to OECD data, only Mexico ranks worse than the U.S. in terms of old-age «poverty depth,» which means that among those who are poor, their average income is low relative to the poverty line. And just three countries have worse income inequality among seniors.

There are many contributing factors to these poverty

Read more on cnbc.com