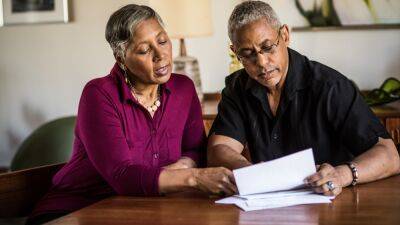

401(k) savers will see a 'wake-up call' in their next statement, says law professor. Here's what to look for

You may get a nasty surprise when you open your next 401(k) statement.

These statements generally arrive each quarter, either online or by mail. They provide basic information to savers about their investments and the size of their nest egg, for example.

Starting in a few weeks, the notices will contain some new data: the amount of monthly income a saver would get from their current nest egg in retirement.

More from Personal Finance:Hot inflation points to record Social Security COLA in 2023Pandemic stimulus checks were a big experiment. Did it work?More companies offering an after-tax 401(k) option to big savers

Called «lifetime income illustrations,» these calculations are part of an ongoing effort by policymakers to reframe how Americans think about retirement savings: like a regular check from work or Social Security, for example, instead of a lump sum.

The big-picture view of a lump sum may tell investors little about how their total savings will or won't adequately fund their retirement lifestyle. A $125,000 nest egg may sound like an ample amount to some savers, but may seem less so if they realize it translates into roughly $500 or $600 a month, for example.

«For the bulk of Americans, it'll be a wake-up call,» Richard Kaplan, a law professor at the University of Illinois, said of the new disclosures.

But there's good news: Many people, especially those with decades to retirement, have ample time to fix any shortfalls.

Many 401(k) savers will see the disclosures for the first time on their next quarterly statements, due to U.S. Department of Labor requirements. Those statements, issued by plan administrators, will arrive in the days and weeks after June 30.

The new policy is a result of federal legislation — the

Read more on cnbc.com