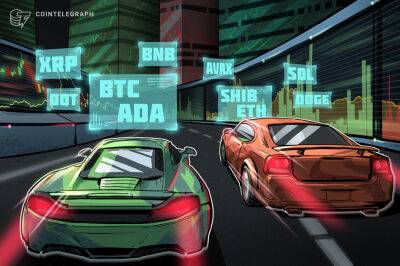

3 key indicators traders use to determine when altcoin season begins

It's widely accepted that the fate of the cryptocurrency market depends largely on the performance of Bitcoin (BTC), which makes times like these for crypto traders who prefer to invest in altcoins.

When BTC price is down, altcoins tend to follow, but as a bottoming process begins, altcoins tend to perk up during Bitcoin's consolidation phases and this typically leads to call for an altcoin season. While Bitcoin's current dip below $30,000 shows that it's a bit premature to call for an altseason, analysts are still charting a variety of different outcomes that point to an altcoin season. Let's have a look.

Insight into the possibility of an altcoin season using the ETH/BTC chart as an indicator was discussed by analyst and pseudonymous Twitter user PlanDeFi, who posted the following chart comparing the 2016 to 2017 performance of ETH/BTC against the pair's performance in 2021-2022.

PlanDeFi said,

Based on the projection provided, the next altseason could kick off sometime after the start of July and it has the potential to extend through the end of 2022.

Further evidence that the market may be approaching an inflection point was provided by El_Crypto_Prof, who posted the following chart looking at the history of the altcoin market capitalizatio.

El_Crypto_Prof said,

Related: Fed money printer goes into reverse: What does it mean for crypto?

While fractals are pleasing to the eye and give hope to disillusioned traders, most fail to materialize and they are not accurate analysis methods to rely on when trading.

The "Altseason indicator" provides a more metrics-based method for predicting when the market is in "Bitcoin season" and "altcoin season."

According to the chart above, it does not appear as though an altseason is likely

Read more on cointelegraph.com

![For Decentraland [MANA] traders the next major support levels lie at… - ambcrypto.com](https://finance-news.co/storage/thumbs_400/img/2022/6/10/29051_lnc8.jpg)