'War on crypto' — Newly filed letters lambast proposed SEC custody rules

A proposal by the United States securities regulator to tighten rules around crypto custody has been met with opposition from at least two proponents of the industry, according to recently filed letters.

On May 8 — upon the deadline for comments on the proposal — crypto industry advocacy body Blockchain Association filed its letter to the Securities and Exchange Commission (SEC) criticizing its proposal to amend its custody rule.

Three days earlier, a similar letter was sent by Web3 venture capital fund Andreessen Horowitz (a16z).

Marisa Tashman Coppel, a policy lawyer at the Association tweeted on May 8 claiming the rule would “drastically curtail investment in digital assets” and — in its current form — the rule is “unlawful.”

1/ Today, @BlockchainAssn filed a comment letter to the SEC’s proposed custody rule. With recommendations, we explain how the rule would drastically curtail investment in digital assets and why finalizing the rule in its current form would be unlawful.https://t.co/zRrPkdiWn9

The same day, a16z’s general counsel Miles Jennings tweeted its letter saying the firm “did not mince words” and called the proposal a “misguided and transparent attempt to wage war on crypto.”

In its letter, the Blockchain Association provided over a dozen separate arguments to rebuff the SEC’s proposal. Among other claims it said the rule exceeds the SEC’s authority, would inhibit advisors from transacting with crypto exchanges and would leave investors' assets at more risk.

A16z detailed similar arguments in its letter but focused more on its effects on registered investment advisers, namely that advisors would be prevented from using crypto and the rules could violate the duty of care the SEC requires of such firms.

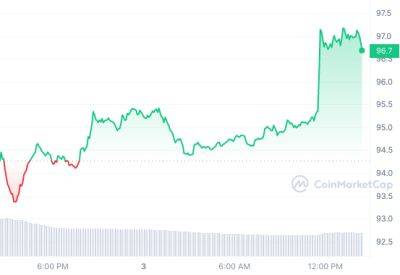

On Friday,

Read more on cointelegraph.com