This Metric of Bitcoin (BTC) Price Momentum Just Fell to its Lowest Since March – Is Now a Good Time to Buy?

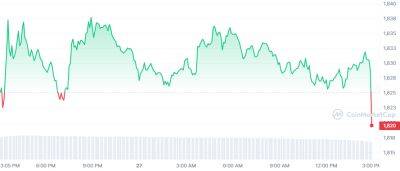

A key metric that measures momentum in the Bitcoin price just fell to its weakest level since March.

Last week, Bitcoin’s Z-score to its 200-Day Moving Average fell under 1.0, where it has remained more or less ever since.

That means that the current Bitcoin price is only just under one standard deviation above its average daily closing price over the past 200 days.

This time last month, a few days after Bitcoin had printed its highs for the year above $31,000, Bitcoin’s Z-score to its 200DMA was 2.27.

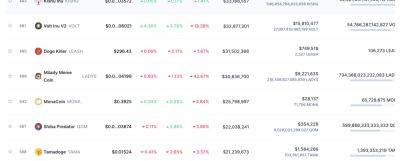

Bitcoin’s loss of price momentum over the last few weeks comes as traders book profit in wake of this year’s impressive rally and temper their optimism about how much further Bitcoin might rally over the remainder of the year amid a continued cloud of uncertainty regarding the US crypto regulation outlook and how much, if at all, the Fed will cut interest rates in the second half of the year.

Arguably, high Bitcoin transaction fees amid a surge in block space demand as the new BRC-20 standard of crypto tokens issued directly on-chain gains in popularity has also been weighing on the price.

It has certainly acted as a deterrent for the blockchain’s more traditional usage as a digital currency ledger – active daily users and the number of new addresses interacting with the blockchain on a daily basis have both fallen off a cliff in recent weeks, though daily transactions has surged to record highs.

While it by no means guarantees that the Bitcoin price doesn’t have further to fall in the short-run, a Z-score to the 200DMA of around of just under one has often been a good time to buy Bitcoin, if the cryptocurrency is deemed to be in the early of middle stages of a bull run.

Take the 2015 to 2018 bull run, for example.

The line that

Read more on cryptonews.com