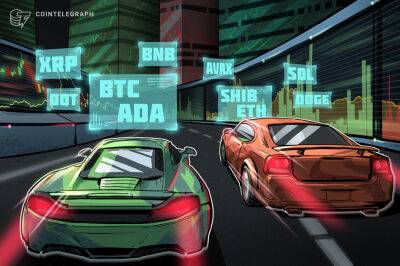

Price analysis 6/6: BTC, ETH, BNB, XRP, ADA, SOL, DOGE, DOT, AVAX, SHIB

After nine successive weeks of red weekly candles, Bitcoin (BTC) printed a green weekly candle on June 5. Leading into this week, buyers kept up their momentum with a strong weekly open that boosted BTC price to $31,800.

Going forward, traders might keep a close eye on the Consumer Price Index (CPI) data for May, which is due on June 10. Depending on the figures, this could keep the volatility elevated as investors digest the report and speculate on the next possible move of the United States Federal Reserve.

Analysts are divided about the next directional move for Bitcoin. While some believe a bottom has been made, others anticipate another leg down. For analyst Bob Loukas, the price action in the summer could remain uninteresting and he expects the new cycle to begin late in the year.

Could bulls sustain higher levels or will bears sell aggressively and pull the price down? Let’s study the charts of the top-10 cryptocurrencies to find out.

After two small range days on June 4 and 5, the range expanded on June 6 and Bitcoin soared above the 20-day exponential moving average (E($30,510). The bulls are attempting to push the price to the overhead resistance at $32,659.

The price action of the past few days has formed an ascending triangle pattern, which will complete on a break and close above $32,659. If that happens, the BTC/USDT pair could start a new up-move. The pattern target of the breakout from the triangle is $38,618.

The 20-day EMA has flattened out and the relative strength index (RSI) is near the midpoint, suggesting that the selling pressure is reducing.

This positive view could invalidate if the price turns down sharply and plunges below the trendline of the triangle. The pair could then drop to the strong support

Read more on cointelegraph.com