Price analysis 4/19: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, SOL, DOT, LTC

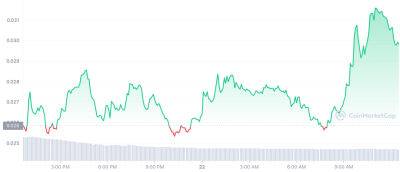

Bitcoin (BTC) has been witnessing volatile moves in the past three days. The pick-up in volatility shows that the buyers and sellers are vying for supremacy.

Bitcoin recovered sharply on April 18 but gave back all the gains on April 19. The latest sell-off may have been triggered by the high inflation figures in the United Kingdom and the regulatory uncertainty in the United States. Profit booking was not limited to Bitcoin as most major altcoins also turned lower.

While a deep correction is possible, Glassnode said in its analysis on April 17 that several on-chain indicators are pointing toward the end of the bear market. If that is the case, the dips may be viewed as a buying opportunity by long-term investors.

What are the important support levels that are likely to be guarded by the bulls? Let’s study the charts of the top-10 cryptocurrencies to find out.

Bitcoin is witnessing a keen battle between the bulls and the bears at the 20-day exponential moving average ($29,092). The bears are trying to sink the price below the 20-day EMA while the bulls are attempting to start a strong rebound.

If the price snaps back from the 20-day EMA, it will suggest that the sentiment remains positive and that traders are viewing the dips as a buying opportunity.

The bulls will then make one more attempt to overcome the resistance zone between $31,000 to $32,000. If they succeed, it will indicate the resumption of the uptrend. The BTC/USDT pair may then soar to $40,000.

The bears are likely to have other plans. If they tug the price below the 20-day EMA, the selling could accelerate and the pair may slump to $27,800 and subsequently to $26,500.

The bulls tried to resume the uptrend in Ether (ETH) on April 18 but the bears remained sellers

Read more on cointelegraph.com