Polkdot [DOT]: Bulls focused on $8 – Is it even attainable?

Disclaimer: The information presented does not constitute financial, investment, trading, or other types of advice and is solely the writer’s opinion

Polkadot [DOT] bulls were upbeat about the $8 value after overcoming a hot sell pressure zone. So far, DOT has rallied by 70%, building on the impressive upswing in January. But most importantly, recent Bitcoin’s [BTC] retest of $25K boosted DOT bulls to overcome a crucial sell pressure zone.

Read Polkadot’s [DOT] Price Prediction 2023-24

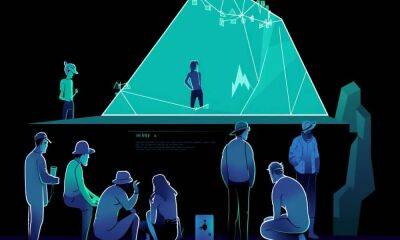

Source: DOT/USDT on TradingView

DOT faced significant challenges despite the rally witnessed in the past several weeks. At the end of January, it went into an extended consolidation phase and oscillated between $6.103 and $6.614. It broke above the range on February 3 but hit the supply zone at $7.000, prompting it to break below the ascending line.

The price rejection at $7.000 set DOT into a correction and lost about 14% of its value. But the plunge was checked by the previous $6.103 support level. After that, the recovery inflicted by bulls cleared the obstacle at $7.000 and flipped the resistance into support.

At the time of writing, the support was confirmed, clearing bulls to target higher resistance levels. Long-term bulls could target $8 if they cleared another hurdle at $7.751.

A break below the $7.000 resistance-turned-support will invalidate the bullish thesis. Such a downswing will tip bears to look for shorting opportunities at $6.614 or $6.103. An extremely bearish scenario could see DOT hit the $5.000 level.

How much are 1,10,100 DOTs worth today?

Source: Santiment

DOT saw an improved investors’ outlook, as shown by retreating weighted sentiment.

The sentiment moved from the negative territory and was slightly

Read more on ambcrypto.com

![Avalanche [AVAX]: Despite these developments, bulls face resistance - ambcrypto.com - city Santimentbut](https://finance-news.co/storage/thumbs_400/img/2023/2/23/57101_xbr.jpg)

![Binance USD [BUSD] maintains its peg even as outflow increases - ambcrypto.com](https://finance-news.co/storage/thumbs_400/img/2023/2/18/56378_zkcb.jpg)

![Aptos [APT]: Bears eke out a victory over bulls – cause for concern? - ambcrypto.com](https://finance-news.co/storage/thumbs_400/img/2023/2/18/56304_bply.jpg)