Over 20 investment funds hold Dash, and 40 more plan to add it: Report

Cointelegraph Research conducted a first-of-its-kind survey querying over 2,000 global crypto funds and certificates to gain an insight into their investment allocations during 2021. The survey was conducted via email between March 2021 and December 2021. The 200 funds that responded collectively managed approximately $1.2 billion in cryptocurrency and blockchain investments.

Interestingly, the study found that 20 surveyed asset allocators already have exposure to Dash in their portfolio, including Valkyrie, Parallax Digital, Block Ventures, INDX Capital and others. An additional 40 funds reported that they wanted to invest in Dash during the next 12 months, and 70% of respondents requested to receive the final results of Cointelegraph’s Dash investment thesis report.

Download the full report, complete with charts and infographics

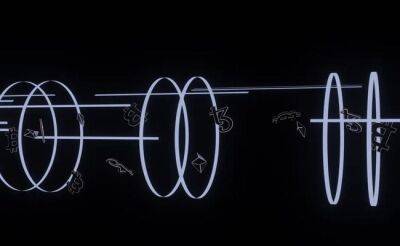

Dash aims to solve the blockchain scaling problem while remaining decentralized by combining the proof-of-work and proof-of-stake consensus mechanisms. According to Cointelegraph Research, Dash’s average transaction fee in 2021 was $0.005, compared with Ethereum’s $21.90 and Bitcoin’s $10.30. Users can benefit from Dash’s instant transactions when paying at merchants in several countries, and its staking rewards and historical financial performance compared with other assets have been impressive. 2022 marks an important milestone in Dash’s evolution, as the mainnet launch of Dash Platform will enable developers and users to embrace the benefits of decentralized applications.

Cointelegraph Research’s new report analyzes Dash and its main functionalities and developments in recent years. The cryptocurrency has been used for everyday payments since its launch in 2014, utilizing technological

Read more on cointelegraph.com