JPMorgan Anticipates SEC Approval of Spot Bitcoin ETFs After Grayscale's Victory

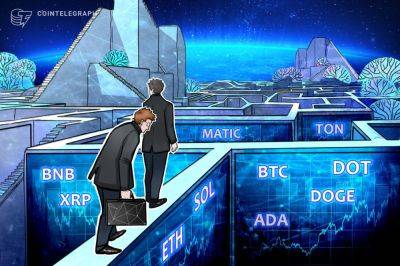

The US Securities and Exchange Commission (SEC) will likely be forced to approve multiple spot Bitcoin (BTC) exchange-traded fund (ETF) applications following the recent Grayscale victory.

In a Friday note, JPMorgan analysts led by Nikolaos Panigirtzoglou wrote that Grayscale’s win implies that the SEC would have to retroactively withdraw its previous approval of futures-based Bitcoin ETFs in order to defend its denial of Grayscale’s proposal of converting its Bitcoin trust into an ETF.

However, such a move would be “very disruptive and embarrassing for the SEC” and appears unlikely, the analysts said, adding:

"It looks more likely that the SEC would be forced to approve the spot bitcoin ETF applications that are still pending from several asset managers, including that from Grayscale."

Last week, the US Court of Appeals for the District of Columbia Circuit ruled in favor of Grayscale, ordering the SEC to set aside its earlier rejection of Grayscale’s application and reopen the review process.

The court ruled that there was no justification for the SEC to allow Bitcoin futures-based ETFs but deny spot Bitcoin ETFs.

It claimed that fraud and manipulation in the Bitcoin spot market pose a similar risk to both futures and spot products because the spot market and the CME futures market are tightly correlated.

Therefore, the SEC's rejection of Grayscale’s proposal was "arbitrary and capricious" because the agency failed to explain its different treatment of similar products, the court ruled.

The SEC said last week that it would delay decisions on spot Bitcoin ETFs proposed by several firms, including BlackRock, Fidelity, and Invesco, until at least mid-October.

However, JPMorgan analysts argued that the postponement "likely

Read more on cryptonews.com