Investor behind top tech fund warns mega-cap rally is running on fumes

The investor behind a top 10 global ETF sees a bearish trend in the Big Tech rally.

Anna Paglia, who oversees the tech-heavy Invesco QQQ Trust, sees signs investors are starting to take a defensive approach to the group.

«If you look at the flows that are flattish year to date, that indicates there's really not a high conviction in the short term,» the firm's global head of exchange-traded funds and indexed strategies told "ETF Edge" this week.

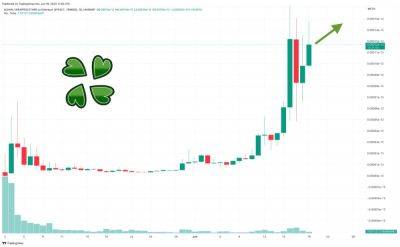

The QQQ, which tracks the Nasdaq 100 index, hit a 52-week high on Friday. Plus, it has outperformed the S&P 500 by more than 17% in 2023.

More than half of the fund's allocations are in technology stocks. The ETF's top holdings include Microsoft, Apple, Amazon and Alphabet — which are up more than 30% since the start of the year.

Two other top holdings, Meta Platforms and Nvidia, are up more than 100% for the year. Nvidia is set to report its quarterly earnings on Wednesday.

«People don't know if … this performance is only driven by the mega caps or if there's more in there,» she said.

However, Paglia suggests the issues aren't permanent.

«We are still firm believers in the QQQ, but it's a wait and see for our clients,» she said.

The QQQ was up almost 4% this week.

Read more on cnbc.com