Curve founder looks to unexpected counterparties to rescue sinking DeFi loans

Curve Finance founder Michael Egorov is attempting to offload some of his DeFi positions to alleviate his mountain of debt, but some have highlighted his liquidity sources.

On Aug. 1, Nansen research analyst Sandra Leow posted a list of liquidity sources for Egorov’s Curve DAO (CRV) positions.

According to Leow, Egorov sold around 50 million CRV tokens over the counter to several buyers at a below-market rate of $0.40 per token. The sale includes a three to six-month vesting agreement or they can be sold should prices reach $0.80.

The Curve OTC War updates: 17.5M CRV to 0xf51 5M CRV to Justin Sun 4.25M CRV to DCFGod 2.5M CRV to Ox4d32.5M CRV to DWF Labs 2.5M CRV to Cream: Multisig 1.25M CRV to 0xcb53.75M CRV to machibigbrother.eth250k CRV to 0x9bf

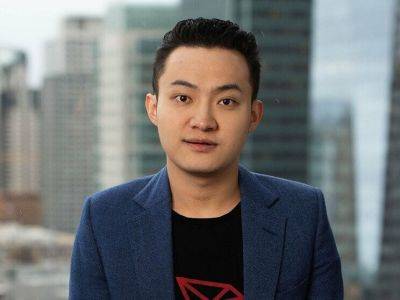

Some of the bigger players involved include Tron founder Justin Sun, who was recently sued by the United States Securities and Exchange Commission.

Other notable buyers included tech entrepreneur Jeffrey Huang, better known as “MachiBigBrother” who Twitter personality ZachXBT accused of embezzling 22,000 Ether (ETH), currently valued at over $41 million, over several projects. Huang has denied the claims and sued ZachXBT for defamation.

DWF Labs, an investment firm that also engages in market making, also snapped up some discounted tokens.

Others include the DeFi lending protocol Cream Finance, "DCFGod" who is listed as part of a team for a nonfungible token (NFT) project and three other crypto wallets.

Wintermute CEO Evgeny Gaevoy suggested some of the people and entities Egorov is dealing with "are kind of questionable" adding Wintermute hadn't onboarded Egorov as a counterparty.

The Curve founder took out a $100 million DeFi stablecoin loan using his own CRV stash as collateral.

Read more on cointelegraph.com