Crypto VC Funding Declines Again in Q3 as Crypto Winter Drags On

The crypto winter that began in 2022 yet to end, according to the latest figures on venture capital (VC) funding for crypto firms presented by data analytics firm FundStrat.

In a new presentation, FundStrat noted that VC funding for crypto firms contracted for a sixth successive quarter to $1.4 billion in Q3 2023, while the number of individual deals dropped 30% to 214.

That’s a near 90% decline from the more than $10 billion in VC funding that crypto firms were able to secure in Q1 2022, shortly after many crypto assets reached their all-time peaks in late 2021.

Still, despite the big decline in the past year and a half, VC funding for crypto firms remains 2-3x above its levels for most of 2018-2020, FundStrat pointed out.

“Despite a sustained decrease in total capital investment, the crypto venture market has continued to attract more interest compared to previous market cycles,” FundStrat noted.

“Potential tailwinds to end 2023 include the increased likelihood of a spot Bitcoin ETF approval and most of the US monetary tightening in the rearview mirror,” the data analytics firm added.

While crypto infrastructure firms continued to attract the most investment in Q3, raising $586 million across 79 deals, their dominance in the VC crypto landscape faded versus Q1 and Q2.

The most notable fund raising round conducted by an infrastructure firm was Flashbots $60 million raise, which gave the company unicorn status (i.e. a valuation of above $1 billion).

Meanwhile, Web3 & NFTs were able to raise $325 million across 55 deals, powered by growth in interest in social apps such as friend.tech, which raised an undisclosed amount in Q3.

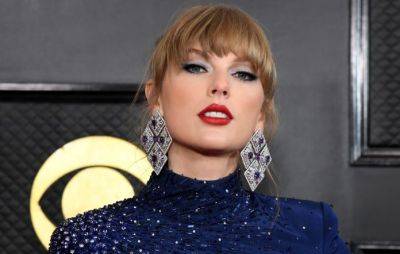

“As content creators begin engaging with audiences in new formats, monetization of intellectual property

Read more on cryptonews.com