Crypto Regulation Needs Teeth: Ex-SEC Official Pushes for DOJ Involvement

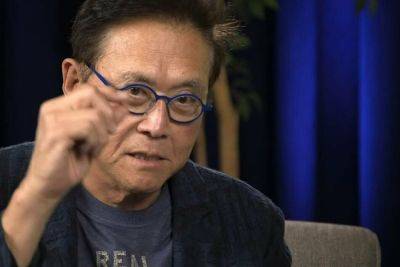

The issue of crypto regulation in the United States has intensified following outspoken criticisms from John Reed Stark, a former SEC official, on Saturday.

Stark emphasized that the SEC’s current enforcement capabilities are not enough to rein in the crypto sector, urging the Department of Justice (DOJ) to take a more active role. Stark voiced his concerns on social media platform X (formerly Twitter), lamenting that enforcement actions by the SEC are often shrugged off by crypto companies as mere business expenses.

Stark, who served in the SEC Division of Enforcement for nearly two decades, including 11 years as the chief of the SEC's Office of Internet Enforcement, highlighted the SEC's restricted reach.

According to Stark, the SEC is limited to civil enforcement and cannot impose prison time for violations, which is why the DOJ’s involvement is crucial.

He remarked that there is an astonishing lack of crypto-related criminal prosecutions by the DOJ, despite close to 200 enforcement actions from the SEC. This imbalance, he argues, creates an environment where crypto firms in the U.S. fail to take SEC charges seriously.

It is not only Stark who raised concerns over enforcement, or the lack thereof, in the crypto industry. Tyler Winklevoss, co-founder of the crypto exchange Gemini, has dismissed SEC allegations as “super lame,” while other major exchanges like Coinbase and Binance have publicly downplayed their SEC charges.

Stark pointed out that such attitudes reflect a broader trend within the crypto in US, where companies continue to treat SEC enforcement risks as just another line item on their balance sheets.

Stark’s criticism comes at a time when debates over the need for stricter crypto regulation are rife. The

Read more on cryptonews.com