BTC price up, fundamentals down? 5 things to know in Bitcoin this week

Bitcoin (BTC) starts a new week in a solid position above $30,000 after its latest rapid gains.

BTC price action continues to deliver on bulls’ expectations after weeks of sideways trading offered little relief. Can it continue?

That is the question on every trader’s mind this week. $30,000 held into the weekly close and beyond, but in a volatile crypto market, anything can and does happen.

The macroeconomic climate is somewhat “standard” for the final week of June, offering some potential risk asset price catalysts but avoiding several major data releases at once.

The weekend’s news out of Russia appears to have had little impact on market performance elsewhere, having mostly concluded before the start of the week’s trading.

Turning to Bitcoin itself, a phase of taking stock appears to be here, with fundamentals conversely primed to shift down from all-time highs.

The sentiment is volatile, too, with $30,000 in particular, a pivotal level.

Cointelegraph takes a look at these factors and more in the weekly rundown of what is moving BTC price action in the short term.

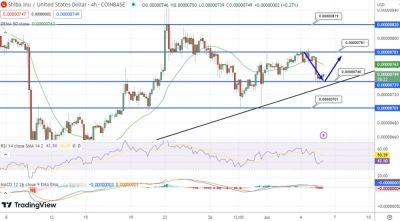

Bitcoin drifted lower through the final part of the weekend after briefly touching $31,000.

Despite a lack of momentum, bulls managed to defend the $30,000 mark overnight, and at the time of writing on June 26, $30,500 was back as a focus, per data from Cointelegraph Markets Pro and TradingView.

In total, BTC/USD gained 15.6% last week, making it its third-best weekly performance of 2023, according to data from monitoring resource CoinGlass.

“This week is all about flipping that resistance zone / supply zone at $31,000 into support,” popular trader Crypto Tony told Twitter followers.

He added that both Bitcoin and Ether (ETH), the largest altcoin by market cap, were

Read more on cointelegraph.com