Brazil’s Central Bank Tightens Rules as Crypto Adoption Rises

The central bank of Brazil has vowed to tighten rules and strengthen its oversight of crypto platforms, as crypto adoption in the country surges higher.

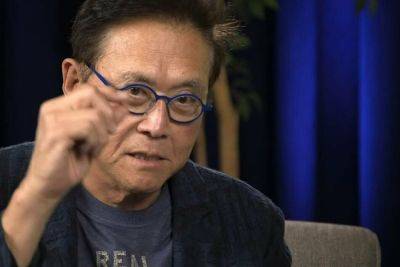

Speaking in front of a parliamentary commission on finance and taxation on Wednesday, Roberto Campos Neto, the governor of Brazil’s central bank, said “cryptocurrency imports” by Brazilian residents have risen 44.2% in the period between January and August 2023 compared to the same period last year.

In total, around 36 billion Brazilian real ($7.4 billion) worth of crypto has been brought into the country during the period, the central bank governor said.

“We understand that a lot is connected to tax evasion or linked to illicit activities,” Neto said, while stressing that oversight of the crypto sector in Brazil will be strengthened going forward.

In his speech, Neto noted that stablecoins have become particularly popular in Brazil, and said they are mainly used as payment for goods and services.

That stands in contrast to unbacked cryptocurrencies like Bitcoin (BTC) and Ether (ETH), which are mainly used as investment and savings vehicles.

Known locally as Banco Central do Brasil, Brazil’s central bank has been given a key role in regulating the emerging crypto sector in the country.

Besides overseeing the so-called private crypto market, the central bank is also working on its own central bank digital currency (CBDC), a digital version of the Brazilian real.

In June, the bank unveiled a “roadmap” of events, including monthly webinars, ahead of the nation’s CBDC rollout.

The events will run until November and will see the bank, fintech experts, and BCB partners discuss CBDC rollouts, as well as the results of the BCB’s own digital real pilot.

In July, Brazil’s CBDC pilot again

Read more on cryptonews.com