Bitcoin price tumbles to 10-day lows as 'Notorious B.I.D.' keeps support at $22.5K

Bitcoin (BTC) threatened to ditch $23,000 as support on Feb. 25 as an ongoing price correction strengthened into the weekend.

Data from Cointelegraph Markets Pro and TradingView showed BTC/USD attempting to make a decision on the fate of the $23,000 mark on the day.

The pair had lost almost $1,000 on Feb. 24, ending the week in a limp position along with United States equities while the dollar gained.

With “out-of-hours” trading now in place until Monday, chances for thinner liquidity to spark more pronounced moves heightened.

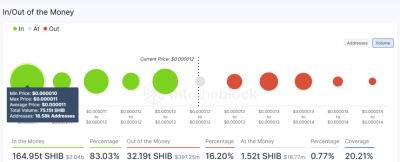

Analyzing the state of the Binance order book, monitoring resource Material Indicators confirmed the continued existence of a major line of bid support informally known as the “Notorious B.I.D.” and “great wall.”

Previously higher up, the owners of the liquidity had moved it lower during the week.

“If the Notorious B.I.D. wall at $22,250 holds, I expect it to be part of the weekend whale games. I would not be trying to catch knives,” Material Indicators commented.

Turning to the upcoming weekly close, trader and analyst Rekt Capital meanwhile delineated $23,300 as important to hold to protect bulls' interests.

"Weekly retest of the confluent area that is the Lower High and Monthly Range High resistance is now in progress," he wrote in a Twitter update.

An additional post argued that the monthly close would be a key determining factor in the overall trend, this also being just days away.

A failed #BTC Weekly retest of ~$23400 as support would mean that price remains inside the Monthly Macro RangeLet's see how the Monthly Closes1M Close above ~$23400 -> likely range breakout1M Close below -> $BTC stays in & range & could dip lower in range#Crypto #Bitcoin pic.twitter.com/xTAqH7pVlm

Others showed signs of

Read more on cointelegraph.com

![Bitcoin [BTC] bears keep the faith as short funds see $10M inflows: Report - ambcrypto.com - Usa](https://finance-news.co/storage/thumbs_400/img/2023/2/28/57713_m6ab9.jpg)