Bitcoin Price Prediction as US Core Inflation Rate is Announced – Is the Bear Market Officially Over?

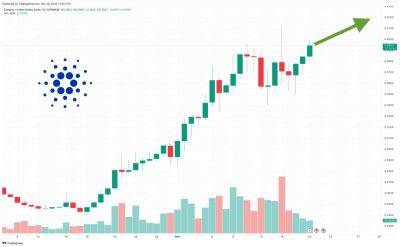

Bitcoin (BTC) is trading at daily lows in the $36,100s in wake of the release of the latest US inflation figures for October, despite the numbers coming in lower than expected across the board.

The headline Consumer Price Index (CPI) showed prices remaining flat in October, less than an expected rise of 0.1%, and rising at a rate of 3.2% YoY, less than the expected 3.3%.

The Core CPI, which is more closely watched by the US Federal Reserve to gauge underlying price pressures, rose just 0.2% MoM, below the expected 0.3% and in fitting with an annual core inflation rate of just over 2.0% (the Fed’s inflation target).

The latest inflation figures, which come on the heels of soft US labor market and manufacturing PMI data released earlier this month, paint a picture of a US economy that is cooling off, reducing the need for the Fed to keep on raising interest rates, which are high relative to the inflation rate at 5.25-5.5% (meaning a high “real interest rate” and tight financial conditions).

That’s the way investors seem to be viewing it anyway.

As per the CME’s Fed Watch Tool, US money markets are currently pricing a 0% chance of any further interest hikes this cycle, and a 30% chance that the Fed starts cutting interest rates as soon as March, up from a 10% chance prior to the release of the latest inflation figures.

As bets on an imminent Fed cutting cycle ramp up, the US Dollar Index (DXY) and US government bond yields are dumping, whilst US stock prices are pumping.

The DXY fell over 1% on Tuesday to new two-and-a-half-month lows at 104.50, the US 10-year yield fell nearly 20bps to hit near two-month lows under 4.50% and S&P 500 pumped 1.7% to near September’s highs around 4500.

Given Bitcoin’s historic positive correlation to

Read more on cryptonews.com