Bitcoin options tantalizing bears to push price below $30K before Friday’s expiry

This week’s Bitcoin (BTC) options expiry on Friday, July 21, could solidify the $30,000 resistance level and give the bears the upper hand for the first time since the 21% rally between June 14 and June 21.

A review of Bitcoin’s recent price action shows that three out of the last four BTC options expiries triggered significant price movements, making it crucial for traders to pay close attention to these events.

Notably, Bitcoin’s price has consistently shown strong reactions following the weekly 8:00 am UTC options expiry. While causation cannot be established, the magnitude of these price swings warrants extreme caution leading up to the weekly expiry on July 21.

While this week’s options expiry could give bears control of Bitcoin’s price in the short term, bulls have the potential advantage of the United States Securities and Exchange Commission reviewing spot exchange-traded fund proposals.

Although these proposals are still in the early stages of regulatory scrutiny, the slow progression could partially explain why the bears have managed to defend $31,000 multiple times since late June.

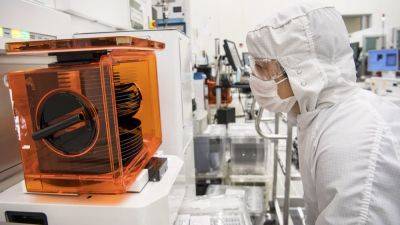

However, their best chance of keeping Bitcoin’s price below $30,000 lies in the worsening regulatory environment. On July 19, the global securities exchange Nasdaq suspended the launch of its cryptocurrency custodian solution due to a lack of regulatory clarity in the United States. This change of plans was justified by Nasdaq’s CEO, Adena Friedman.

Related: Bipartisan bill to regulate DeFi, crypto security risks introduced into US Senate

Furthermore, on July 14, cryptocurrency exchange Coinbase announced the suspension of its staking services for clients in California, New Jersey, South Carolina and Wisconsin. This decision

Read more on cointelegraph.com