Best Crypto to Buy Now 10 April – STX, BGB, AGIX

Over the weekend, the cryptocurrency market experienced low volatility as Bitcoin continued to trade around $28,000.

With prices moving sideways and trading volume increasingly declining, heightened volatility may be on the horizon.

Hence, people looking to invest in the cryptocurrency market should closely monitor upcoming events and key indicators that could affect the selection of the best cryptos to buy now.

The recent slowdown in employment and wage growth, while seemingly unfavorable for the economy, has led some investors to believe that the Federal Reserve may adopt a more cautious stance on interest rate hikes.

In light of this, the release of the Consumer Price Index (CPI) this Wednesday will be closely monitored for its potential influence on interest rate adjustments.

Earnings season is also upon us, and it's expected to paint a bleak picture of corporate performance for the first quarter.

With a predicted 6.6% decline, this marks the worst earnings drop since the pandemic's onset in the second quarter of 2020.

As these factors converge, the stage is set for significant market volatility in the coming weeks.

If the crypto market continue to hold its ground and is positively impacted by macroeconomic developments, it is possible that Bitcoin could test $30,000, and Ethereum $2,000.

At the time of writing, Bitcoin and Ethereum have shown upward price movements today. Bitcoin is currently trading at $29,144, representing a gain of 2.87% so far today, while Ethereum is trading at $1,896 with a 2% gain.

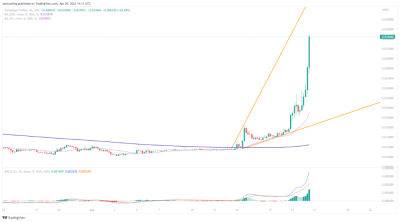

Investors seeking to capitalize on potential market strength may consider buying LHINU, STX, DLANCE, BGB, ECOTERRA, AGIX, SWDTKN, and TARO.

Based on fundamental and/or technical analysis, these are considered among the best

Read more on cryptonews.com