Aussie asset manager to offer crypto ETF using unique license variation

Australian asset manager Monochrome Asset Management has landed the country’s first Australian financial services license (AFSL) for a spot crypto exchange-traded fund (ETF).

Speaking to Cointelegraph, Jeff Yew, CEO of Monochrome Asset Management, said the AFSL approval is significant, as until this point, approved crypto ETFs in Australia only operate under general financial asset authorization and only indirectly hold crypto-assets.

Yew noted that Monochrome’s crypto ETFs, on the other hand, will directly hold the underlying crypto-assets and is specifically authorized by the Australian Securities & Investments Commission (ASIC) to do so.

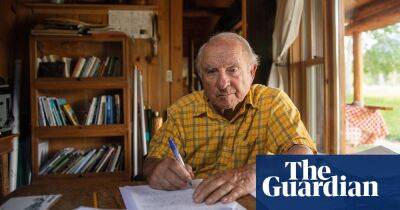

The Monochrome executive said the approval represents a significant step forward for both the advice industry and retail investors:

”Investors investing in Monochrome’s ETFs will know that their funds are investing directly in Bitcoin (BTC) and Ethereu (ETH), and importantly within the regulatory rails established by ASIC specifically for crypto-assets,” he said.

At this stage, there is no firm date when the Monochrome Bitcoin ETF (IBTC) will be made available, but it’s expected in September 2022, once the PDS and TMD have been issued and subject to regulatory approvals.

When the ETFs are made available, Yew says “Monochrome will focus on BTC and ETH because they are the only two crypto-assets currently identified by ASIC as being suitable for retail ETF exposure.”

“Over time, and as the market matures, we will take an open-minded approach to make new products available.”

Operating under an Australian Financial Services Licence (AFSL) with a direct crypto-asset authorization ensures that the fund and the issuer are subject to robust oversight from ASIC, said Yew.

AFSL authorization opens

Read more on cointelegraph.com